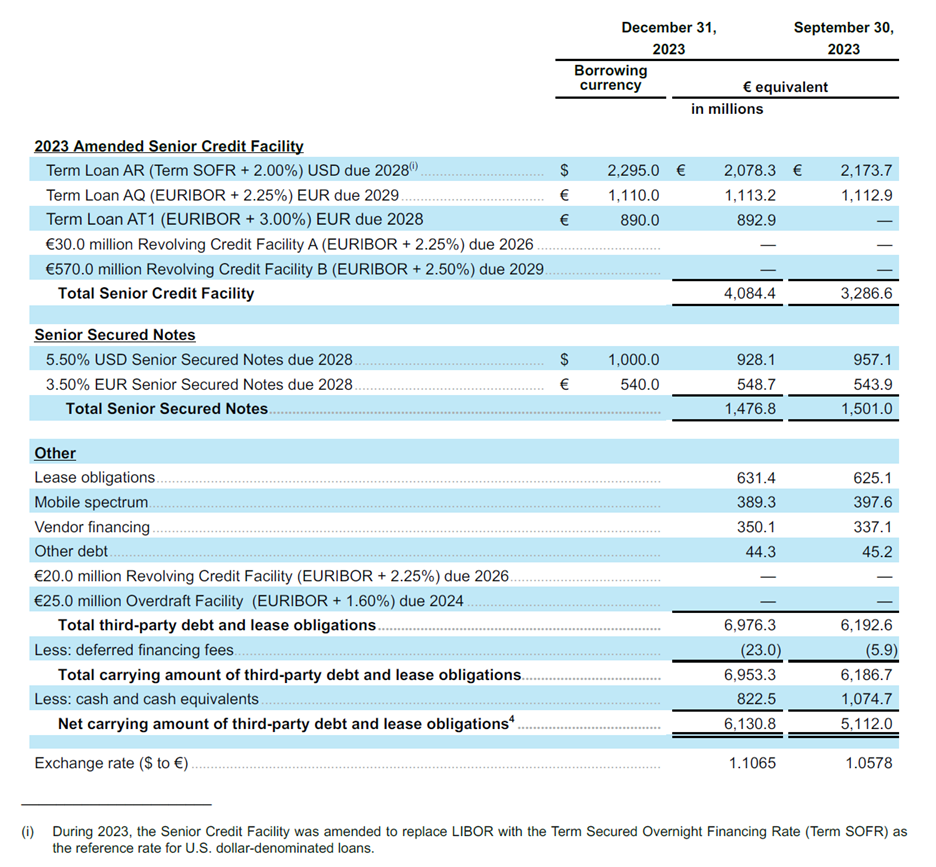

Debt Profile

The following table details our consolidated third-party debt, lease obligations and cash and cash equivalents. The borrowing currency figures reported below reflect the principal amount of the debt instrument in the borrowing currency, while the euro equivalent figures include interest accrued on the respective obligations.

At December 31, 2023, our blended fully-swapped debt borrowing cost was 3.8% and the average tenor of our third-party debt was approximately 4.6 years with no debt repayments, excluding shorter-term liabilities under our vendor financing program, prior to March 2028.

For additional information, we refer to our Q4 2023 earnings release.